Doug Prickett, Senior Managing Director, Research & Investment Analytics

Relentless headlines about eviction moratoriums could have given investors cold feet when it comes to multifamily assets. But despite 18 months of a global pandemic, the sector is performing extraordinarily well.

Deal activity is robust. Asset prices are steadily rising. And despite a dip in some of the nation’s larger urban areas, many secondary markets, especially across the Sunbelt, saw a rise in population that was a boon for the multifamily sector. According to an August 2021 analysis by SeekingAlpha, apartment rents are rising at the fastest rate on record, as the pace of new housing formations has clashed with record-low supply of single-family housing.

As of August, multifamily deal volume approached $135 billion, 90% higher than at the same time last year, and year-over-year pricing increased 14.7%, according to Real Capital Analytics data. The largest transactions have been in markets such as Dallas, Atlanta and Phoenix, all of which set record highs for first-half volume. Meanwhile, the 15 largest apartment REITs, which account for approximately $150 billion in market value and more than 500,000 units across the U.S., saw REIT values surge nearly 40% as of August, according to the Hoya Capital Apartment REIT Index.

A host of economic factors are contributing to these trends, but credit for the sector’s strong performance also goes to the developers and owners who are diving into many of the same issues being discussed in the office sector – specifically, how asset location, unit size and property amenities are once again shifting to accommodate a post-pandemic society. By examining macro and micro trends, with a bit of psychology thrown in for good measure, the sector continues to adapt and evolve in lockstep with demand, positioning it for continued success.

Research Guides Strategy

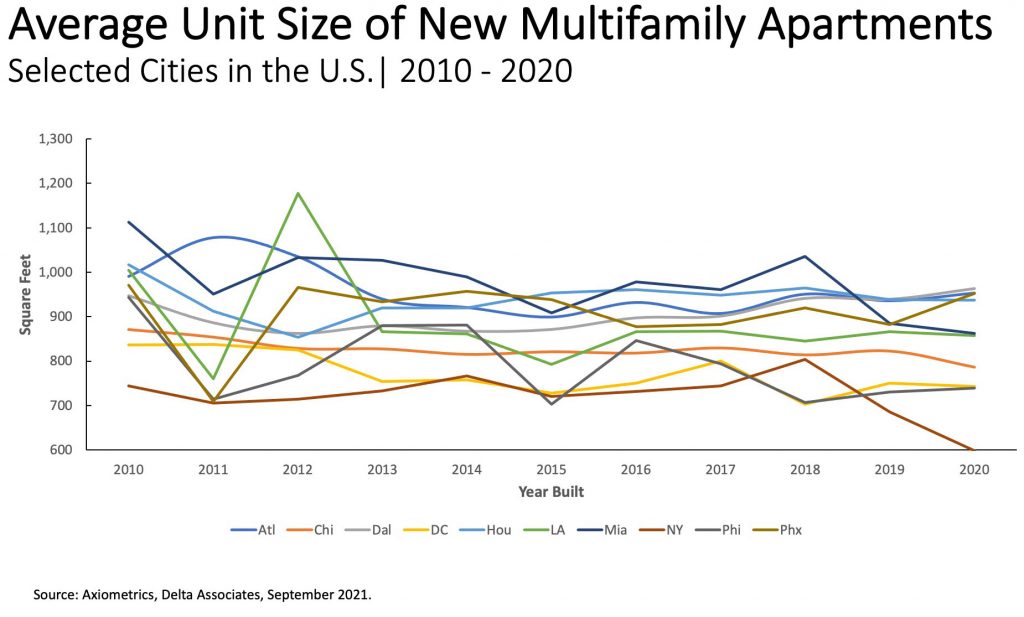

In the decade prior to the onset of COVID, unit size for new construction nationally was trending down, according to Delta Associates, Transwestern’s research affiliate that works with clients across the U.S. In the Baltimore market, for example, average unit size dropped from 1,024 square feet in 2010 to 913 square feet in 2020. Similarly, New York saw a reduction from 745 square feet to 599 square feet, and LA’s unit size shrunk from 1,004 square feet to 858 square feet.

But in 2020, the situation changed. For more than 18 months, renters have needed their apartments to satisfy both requirements of home and work. If a flexible workplace is here to stay, how does the multifamily sector adapt and cater to this new trend?

Developers quickly began to weigh the costs and benefits of larger spaces and revamped communal areas to accommodate shifts in lifestyle, unsure of what the future would bring. As in the office sector, decisions related to floorplans and amenities are akin to placing bets on the future of work as well as a continued intense focus on health and wellness.

While designing properties from the ground up provides an open slate, the average age of the country’s multifamily real estate, as tracked by Axiometrics, is 30 years. Owners of these assets are grappling with how to make their communities desirable in the current social, economic and health situation – meaning they must consider what amenities are preferred and reasonable to offer.

With costs in mind, new development is seeing greater functionality being built into common areas, greater emphasis on outdoor space and some slight changes to units. Modifications include alcoves for conferencing or small meetings in areas already functioning as a lobby or multipurpose room, expanded countertops and/or small workspaces for work-from-home tenants, or space for a home office.

Equally important, the pandemic has not erased other important elements of multifamily real estate. Sustainability ranks as a high priority among many investors, which may influence decisions regarding building materials, cleaning protocols, and heating and cooling solutions. Similarly, social interaction, while perhaps now delivered in different formats, remains important for many renters. And pride of community – whether for the builder owner, tenant or neighbor – is something we all desire in the places we live and work.

Experience Offers Perspective

For investors – and the renters they aim to attract – the adage holds true: One size does not fit all. Even during a global pandemic, commercial real estate has had to flex and shift to accommodate the needs of different geographies, asset types, clients and tenants. Because it caters to such varied audiences, and barriers to entry differ greatly from market to market, this is especially true of multifamily.

When it comes to the place people call home, a segment of the population will always be attracted to the energy of a CBD. As urban areas recapture their vibrancy and renters migrate back downtown, the functional efficiency of new micro-unit communities will appeal to many apartment dwellers. Older apartments close to city center will provide investors opportunities to modernize and lease up empty units. Health and safety concerns will cause others to gravitate to more sparsely populated areas.

In areas with large employers and growing economies, workforce housing will continue to be in demand to support the required labor pool. However, those who work from home regularly may wish to create a more definitive boundary between work and home life, resulting in new floorplans and architectural features. Live-work-play developments have not lost their luster, and multifamily is the heart of this experience. For those looking for a carefree lifestyle that offers posh surrounding and upscale amenities, luxury communities will still have appeal.

In all cases, a strategy that is both informed and flexible, aligning the preferences of a developer or investor with the economic realities of a market, can be a win-win and ensure multifamily continues to be one of the most attractive sectors within commercial real estate.