How This Investment Tool Can Help Support U.S. Economic Recovery

Doug Prickett, CRE

Senior Managing Director

Investment & Analytics

Map courtesy of Economic Innovation Group: eig.org/opportunityzones

Qualified Opportunity zones (OZs) were created by Congress in the Tax Cuts and Jobs Act of 2017 to spur investment in low-income and economically distressed areas by providing tax incentives to those looking to reinvest their capital gains. Authored by the Economic Innovation Group (EIG) and with strong bi-partisan support, the legislation offered a new approach to community and economic development based on the premise that competitive long-term returns can be achieved in areas that are currently weak, assuming strategic steps are taken to unlock the potential.

OZs had a rough start due to the slow release of guidance necessary to inform the rules for investment. After several rounds of IRS guidance, the rules of engagement became clear and updates have been timely, such as the January 2021 notice that extended some deadlines due to the COVID-19 crisis.

Despite OZs having raised approximately $75 billion since they were introduced three years ago, according to a White House Council of Economic Advisers (CEA) report, there has been ongoing debate about whether these vehicles have delivered for both investors and undercapitalized communities. The CEA estimated that approximately 70% of the total—or $52 billion—likely represented new investment that would not have otherwise been directed to OZ census tracts. To date, there is little data available to quantify community improvement.

Early Days

When OZs were certified, some investors were eager to jump in with both feet. For a time, effective marketing campaigns touting attractive incentives drove up pricing on assets and parcels that, while previously undesirable, presented relatively low risk in certain markets. But not all OZs are created equal, and the wide variety in geographies, parcels and properties makes it difficult to draw broad conclusions about the likelihood of success.

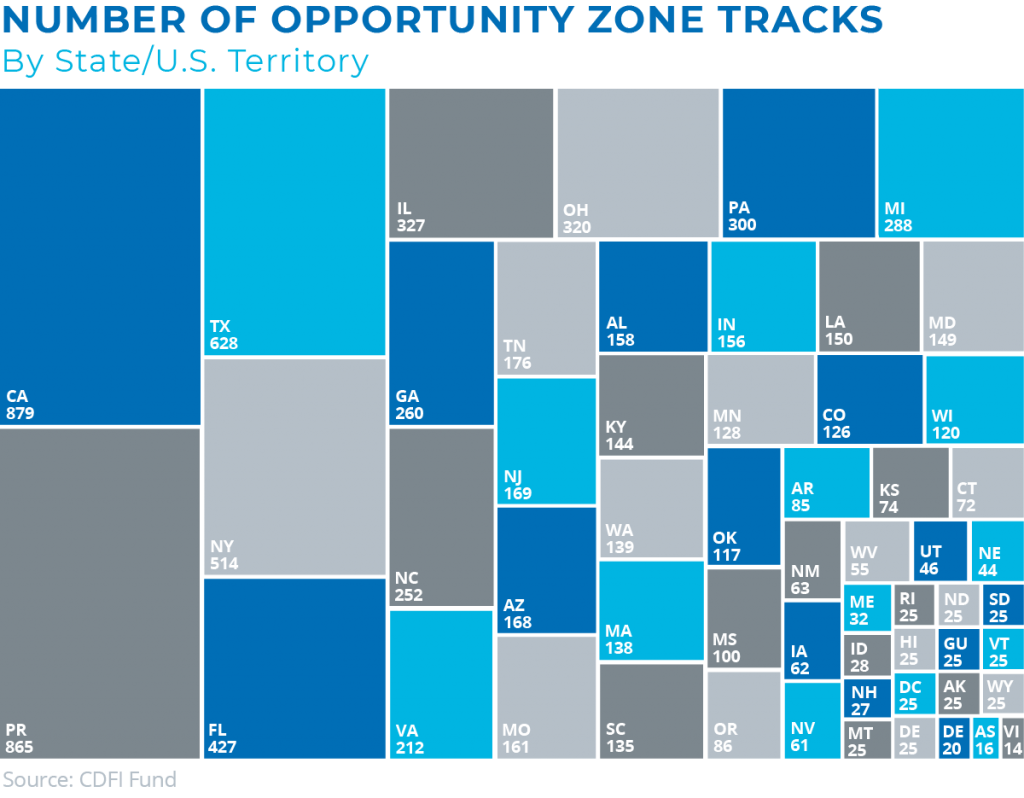

There are more than 8,700 qualified OZs around the United States and its territories, outlined here, and the table by state above provides a sense of the concentrations. They represent 25% of the census tracks in each state and territory that were eligible based on two criteria: a poverty rate of at least 20% or a median family income of less than 80% of its wider region, typically its MSA.

Encompassing 11% of the U.S. population, OZs share many notable demographics. By definition, they are low income areas. They typically have high poverty rates, large minority populations and education levels below the national average. But there are also promising commonalities: OZs are home to 6,300 prime growth businesses, according to SMB Intelligence, poised for investment and expansion.

While some opportunity funds have chosen to invest solely in formation of new businesses, the majority have focused on commercial or residential real estate, in part due to the low-interest rate environment and relatively low prices for distressed assets and unimproved land. Also, real estate developers are much more accustomed to tax incentives.

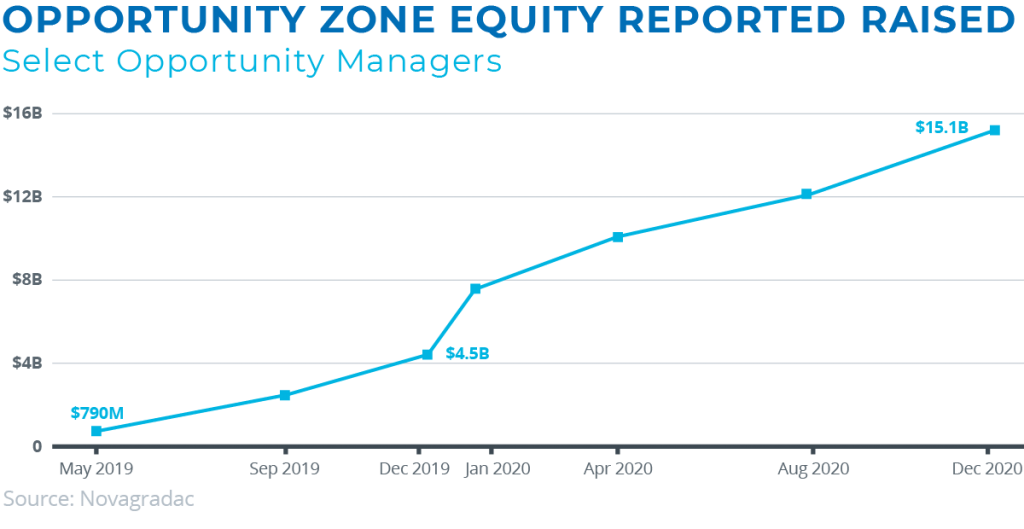

More recently, there has been rapid acceleration in the size of the OZ market. Novogradac’s voluntary survey of opportunity fund managers seeking to raise capital reported $15.1 billion raised in December 2020, up from $4.5 billion one year prior and demonstrating a significant increase. Opportunity funds not raising outside capital are excluded from these figures.

Investment Benefits

It is important to note, an OZ cannot make a bad investment a good investment, but it can make a good investment better. Like most real estate projects, in-depth local market knowledge adds a vital lens to the decision-making process.

At its most basic, an OZ needs three things: an investor with a capital gain, a fund, and a deal. One of the most appealing aspect of this investment tool is that they are designed to be flexible. Unlike a 1031 exchange, dollars are not restricted to a like-kind investment to prevent a tax event. Capital gains from any type of investment – not just real estate but equities, art, jewelry – can go into an OZ fund. The realized capital gains are rolled forward, but the basis is pulled out and not taxed. For real estate deals, single assets as well as portfolios can be acquisition targets, though the former has been more common because it offers greater transparency.

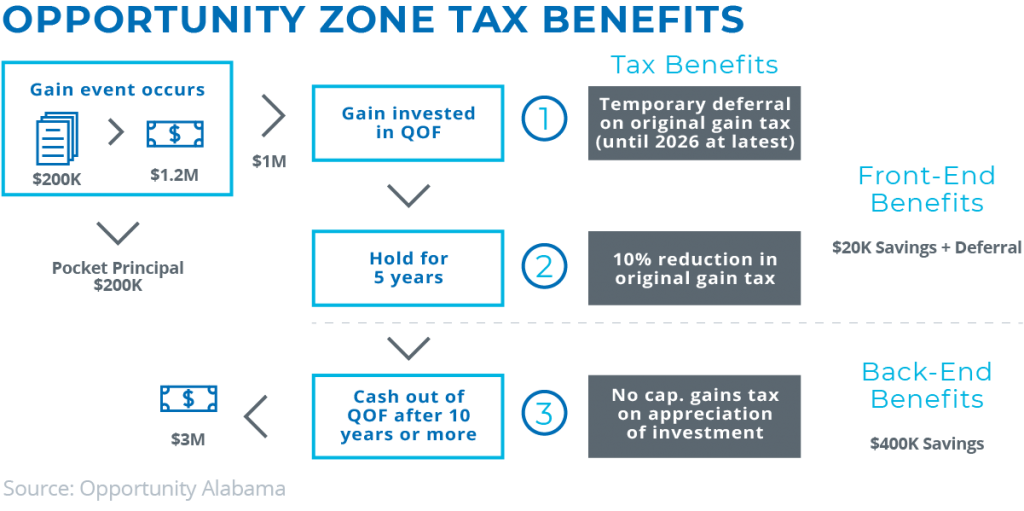

The capital gains savings come primarily in three ways – deferral, reduction, and freedom:

- First, the investor gets to defer the payment of the capital gain taxes on the original investment until December 2026.

- Second, if the investment is held for five years, there will be a 10% reduction on the capital gains tax bill when it comes due in 2026. (Note, this benefit’s five-year window will expire at the end of 2021.)

- Third – the most impactful benefit – the new investment is free of all capital gain taxes if held for 10 years or more.

When considering these benefits and the favorable treatments of depreciation recapture, the capital gains savings can add 300 to 500 basis points to a typical return on investment. For many investors, that’s clearly enough incentive to pencil out the OZ scenario.

CRE Activity

To qualify for an OZ deal, investors must demonstrate that the majority of tangible assets or business activity takes place in the zone. Since property does not move, that makes real estate deals a bit easier than operating company deals. And because investment follows market trends, multifamily and industrial/mixed-use assets have been the most common property types targeted by opportunity funds to date.

There’s no simple formula to follow when it comes to weighing the financial benefits of locating in an OZ. However, a careful analysis that considers all available incentives is worth exploring, especially if your investment strategy accommodates a hold period.

Transwestern Development Company (TDC) has two OZ projects underway. The first is revitalization of a struggling shopping center in Austin, Texas, by redeveloping the site as a mixed-use center with 410 multifamily units, 15,000 square feet of creative office space, and 14,000 square feet of ground-floor retail. TDC worked with neighborhood groups to identify local residents’ needs prior to construction, which led to incorporation of a 1.5-acre park within the project.

The second TDC project is Navara, a 288-unit multifamily asset in Tampa, Florida, located within the Encore Tampa redevelopment. Here, TDC worked with the Tampa Housing Authority to identify the needs of the Encore community, which included an amenity-rich living environment and ground-floor retail space. The project will be National Green Building Standard certified, and 1% of budget is funding a large-scale public art mural on-site.

In the Mid-Atlantic, PerseusTDC, a Transwestern affiliate, is entitling a 235-unit apartment building in an OZ in Hyattsville, Maryland, to help bolster additional city tax revenue and add residentials units to communities in need. This moderately priced apartment building will seek environmental-friendly construction methods and provide metro-accessible housing at workforce housing prices.

Also, rent incentives, moving incentives and tax credits have been enough of a motivator for a Mid-Atlantic life sciences company to locate in an area classified as a Historically Underutilized Business Zone (HUBZone) by the U.S. Small Business Administration. Fortunately, in this case, demographics ensure there will be enough qualified candidates to meet the requirement that employees both live and work in the zone, and Transwestern Real Estate Services has found landlords amenable to some flexibility in a lease with its client to accommodate future growth.

And with healthcare accessibility and delivery continuing to be an important issue, it fit the strategy of another Transwestern client to purchase an asset in an OZ near a hospital as a long-term play.

Optimistic Outlook

All signs point to the current administration being OZ friendly and, with business investment picking up, we expect investors to keep OZs on their radar, as the benefits can be significant if the situation meets the parameters of a sound business strategy. More emphasis on reporting should also shed light on where OZ investments are succeeding or failing from a community betterment perspective.

The economic crisis created by the pandemic may cause some investors to shift their strategies, especially when the plight of small businesses has become more acute and the desire to enrich and preserve local communities is gaining momentum. Many of the areas disproportionately affected by the pandemic are also those in need of investment dollars, and owners embarking on the sale of property in OZs would certainly benefit from highlighting the associated financial advantages. There is no guarantee that OZs will benefit all parties across all geographies equally, despite the good intentions of the original legislation. However, OZs can be a win-win – re-investing capital gains by those willing to take a greater risk with their investment dollars and creating the infrastructure to support a better future for residents.