OUTLOOK

- Property Fundamentals: Expect leasing velocity and net absorption to demonstrate declines. Elective leasing decisions could decline precipitously given disruption to a broad array of industries and the time required to quantify immediate and lasting impacts. Forecasts for a sharp rebound in GDP in Q3 may create a floor for property fundamentals in Q4 as landlords benefit from a firmer grasp of the fallout.

- Capital Markets: With immediate effect, transaction volumes will decline sharply. Lack of conviction relating to the trajectory of cost of capital, property fundamentals and forward tenant demand will create a bid-ask gap between buyers and sellers, as well as borrowers and lenders. MSAs with exposure to energy and tourism will be undermined significantly. Demand for the commercial real estate will not diminish overall, however, and it should continue to outperform volatility and sharply negative returns in other asset classes.

- Office: As businesses “right-size” to the new normal, it is likely many MSAs will experience a net decrease in space utilization. In those locales, the pervasive “flight to quality” trend could evolve to a prioritization on value as businesses seek to take advantage of a more competitive environment among landlords to secure cash flow. Markets with healthy property fundamentals will outperform.

- Retail: Short term, consumers will be further incentivized to shop from home. Longer term, they will prefer e-commerce channels due to added safety concerns, on top of existing convenience considerations. In fact, this phenomenon may already be taking place, manifested by Amazon’s announced plans to hire 100,000 workers to fulfill increase distribution. Ironically, landlord prioritization of “experiential” services will drive underperformance due to disinterest in gathering in crowds impacting nightlife, restaurant and entertainment-focused facilities.

- Lodging: Lodging facilities will experience the largest declines in demand and valuation. With immediate effect, hotels will suffer declines in RevPAR and underwriting confidence. Due to the operational nature of hotels, the space will likely experience further consolidation.

- Industrial: Modernized warehouses will continue to benefit from demand as tenants develop and/or enhance their logistics operations. Manufacturing facilities may experience increased demand from tenants as businesses attempt to onshore manufacturing to reduce exposure to global supply chains.

- Multifamily: Lower interest rates mays lead to greater affordability of mortgage coupons. However, sclerotic job and wage growth may undermine buying power of the cohort representing first-time buyers.

- Important Considerations: Existing property fundamentals are in a very attractive condition. Anticipating slower economic growth, investors have broadly incorporated more conservative underwriting for the past few years. Leverage ratios are significantly lower than in previous cycles, and capitalization spreads to the risk-free rate are significantly wider when compared to the same time period. The industry was exhibiting an excellent balance between supply and demand, and therefore is well-positioned to encounter headwinds. While commercial real estate will experience declines, it will likely continue to outperform as an asset class.

THE WAY THINGS WERE

Transaction Volumes & Asset Valuations

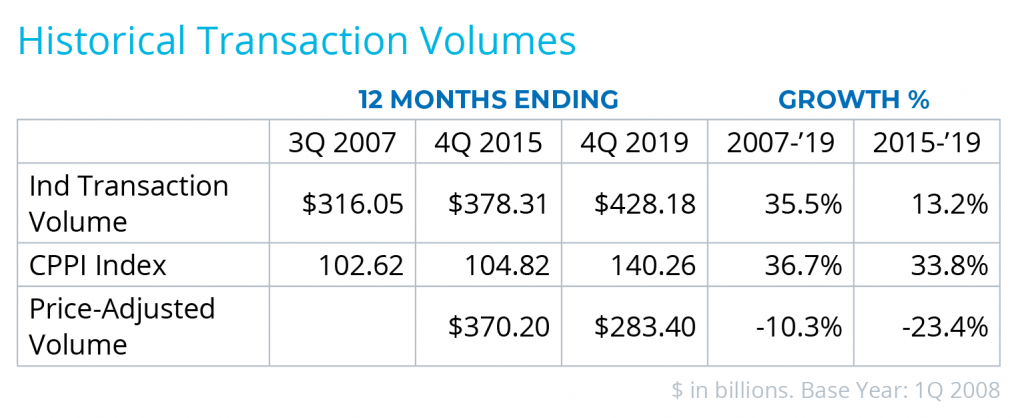

Individual transaction volumes in the United States had risen dramatically from their pre-financial-crisis peak, climbing from $316.05 billion in 3Q 2007 to $428.18 billion in 2019, or approximately 35.5{ff66251fa959225ec0415bec498104472c710c05756e34120ff9c6ac4cef9161}.

However, a more relevant comparison is 2015. After reaching $378 billion in 2015, individual transaction volumes in 2016 and 2017 stagnated as investors considered end-of-cycle risks. Ultimately, volumes recovered in 2018 and 2019 and, in aggregate, rose 13.2{ff66251fa959225ec0415bec498104472c710c05756e34120ff9c6ac4cef9161} from 2015 to 2019.

Meanwhile, pricing of real estate assets grew dramatically at the industry level, with Real Capital Analytics’ CPPI index increasing 33.8{ff66251fa959225ec0415bec498104472c710c05756e34120ff9c6ac4cef9161} in the same time period. Growth in asset valuations was therefore principally responsible for transaction volume growth over the past few years. Specifically, on a price-adjusted basis, individual transaction volumes declined by nearly 25{ff66251fa959225ec0415bec498104472c710c05756e34120ff9c6ac4cef9161}. The valuation increase relates to a strong demand to place increasing capital pools into commercial real estate. However, price-adjusted volumes show discipline among investors who hesitate from acquiring assets at valuations that do not align with their respective return requirements.

Investor Conviction and Dry Powder

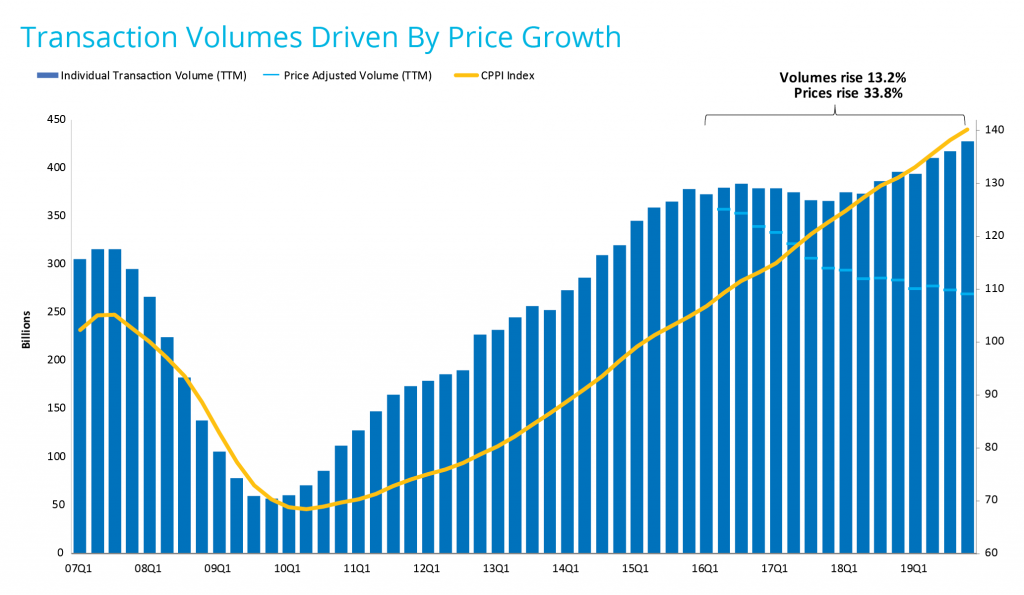

While perhaps difficult to accept, a measure of investor conviction underlies the conflicted perspective among these notions. Dry powder (capital committed to commercial real estate, but not funded) held by commercial real estate investors has remained constant for the past three years, though it has increased as a percentage of annual transaction volume, up to approximately half of 2019 figures. Again, this demonstrates the resolve of investors to place capital they allocated to commercial real estate only at valuations that meet their return requirements.

Among closed-end fund investors, value-add ($62.1 billion) and opportunistic ($71.6 billion) investments represent the most favored strategies, as measured by available dry powder. Ironically, this is where price appreciation and transaction volumes likely exhibited the greatest performance and where price discovery will likely be most apparent in the immediate future. This is the venue for the most substantive change going forward.

THE WAY THINGS ARE

(AND HOW CONDITIONS MAY IMPACT COMING MONTHS)

REIT Valuations

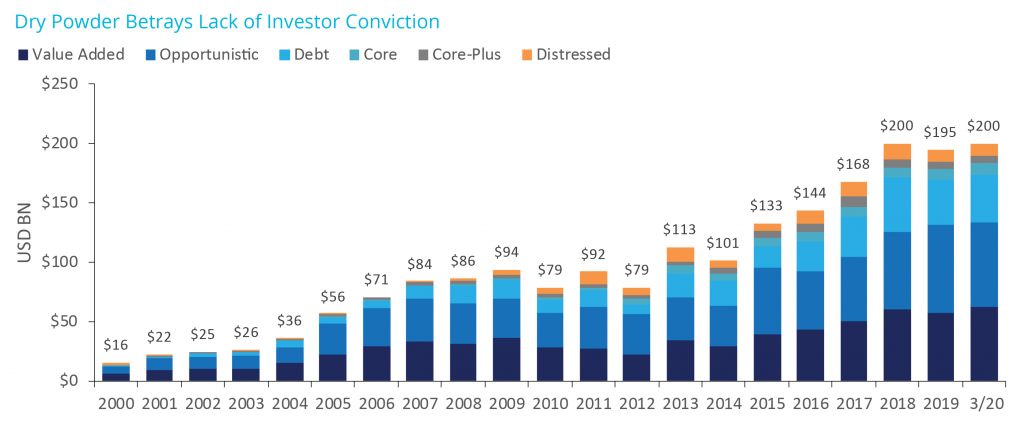

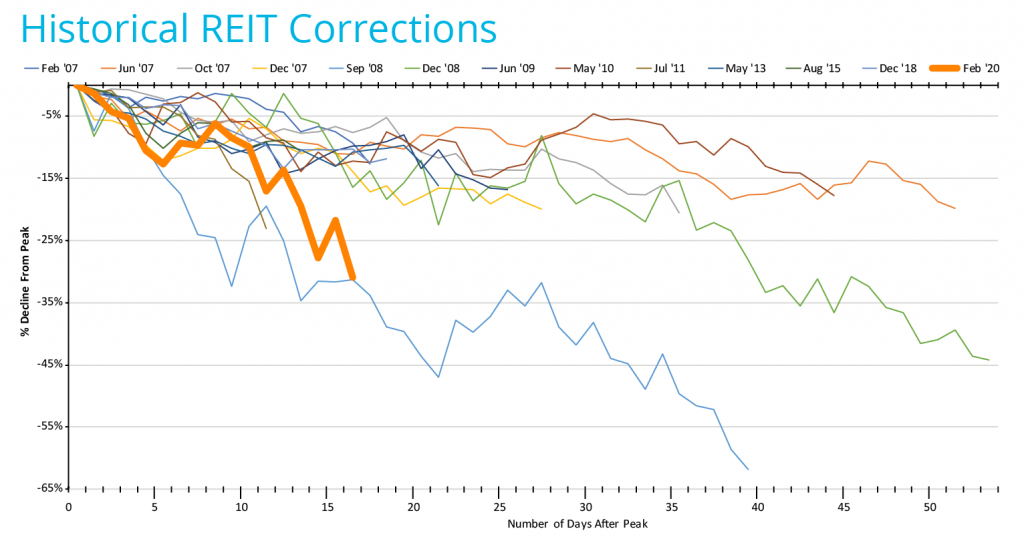

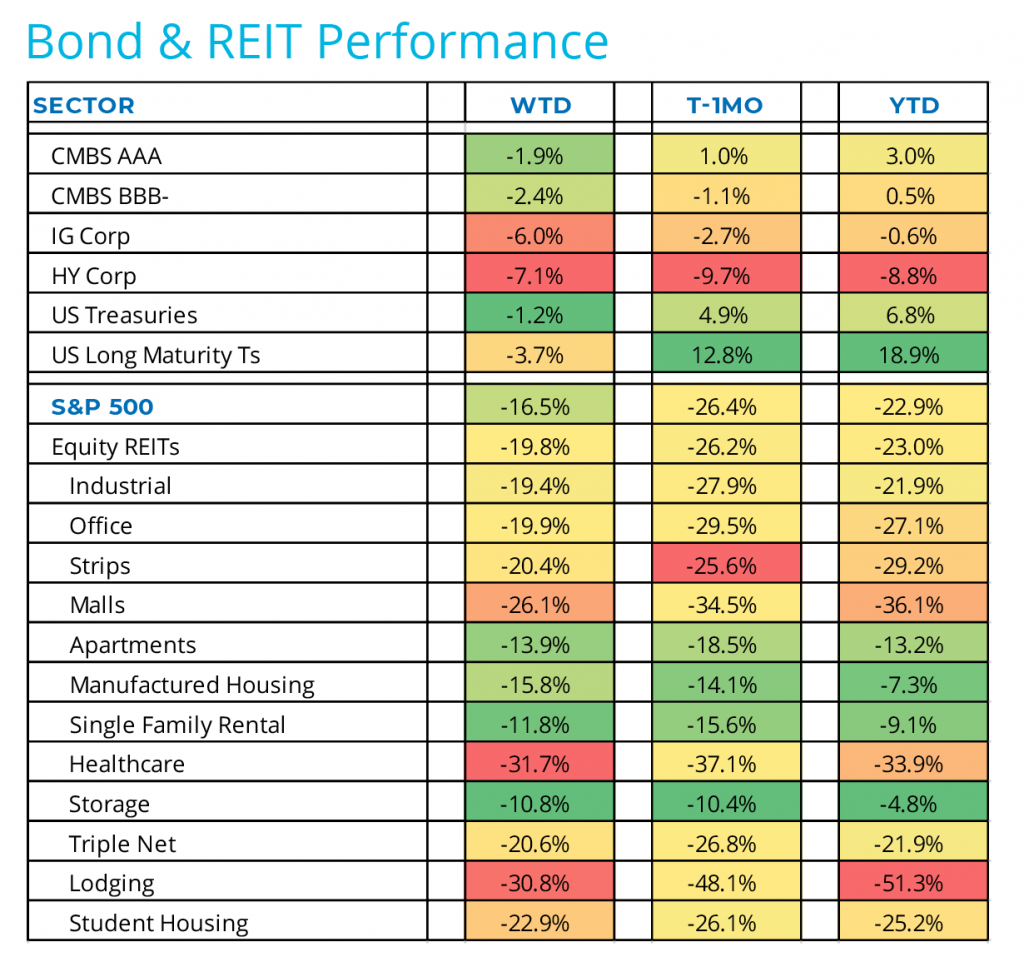

With expectations for both tenant demand and net operating income-related measures receding in real time, the clearest picture of the future may reside in the REIT space, which has experienced a palpable devaluation of equity shares, reversing previous gains associated with a lower interest rate environment. Of 11 Global Industry Classification Standards, Real Estate is the second best-performing YTD, surpassed only by the Tech sector. This is a thin silver lining, however. As of this writing, REITs have suffered a 31{ff66251fa959225ec0415bec498104472c710c05756e34120ff9c6ac4cef9161} decline in valuations since their February highs.

In the past, REIT performance has often presaged that of private commercial real estate – there is little reason to preclude otherwise at this time. Analyzing specific property types, storage and multifamily REITs have been the best performers, though both have recorded declines in value in the low teens. Meanwhile, lodging, malls/strip-retail, healthcare and office assets have underperformed significantly, given they are directly impacted by the decline in demand and/or by their association with the spread of COVID-19. Year to date, substantially half of the property types represented by the REIT industry have now underperformed the S&P 500.

Even darling property types such as healthcare and industrial have been adversely impacted. Though healthcare firms have performed well due to perceived demand and resulting revenue lift, healthcare real estate has not performed well, ostensibly due to pressure on the assets themselves and caution attributed to contagion. Industrial, meanwhile, is being undermined by global supply-chain disruptions, siphoning elation from one of the few remaining favored secular trends driving tenant demand for real estate: e-commerce and resulting logistics expansion.

Risk Versus Return Rebalance

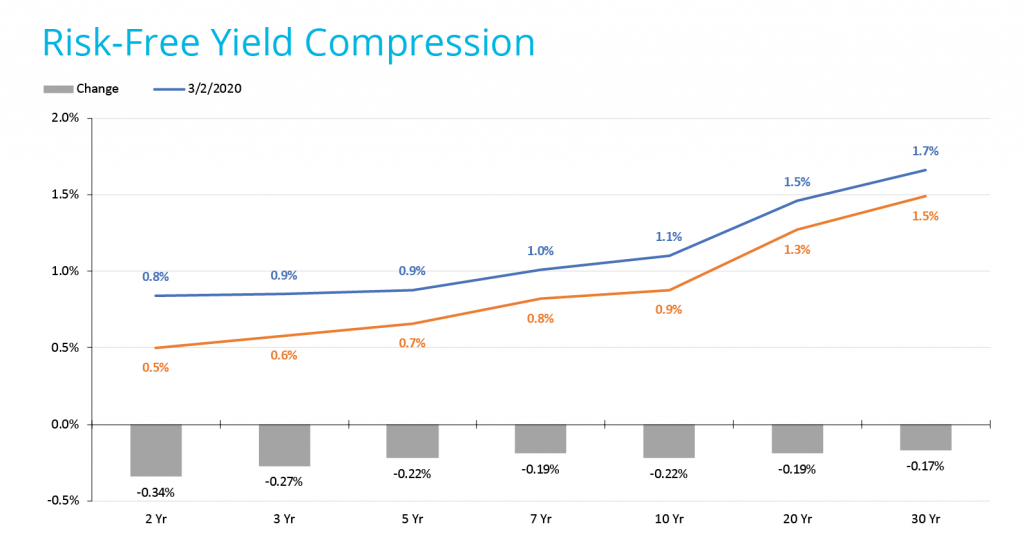

Benchmark interest rates have declined precipitously in March as the Federal Open Market Committee cut its Target Fed Funds Rate 150 basis points to zero percent in two extraordinary announcements outside scheduled meetings, and investors pivot to risk-averse securities such as Treasuries. However, lower-quality, fixed-income securities have illustrated a dearth of investor demand amid weakened underlying financial performance.

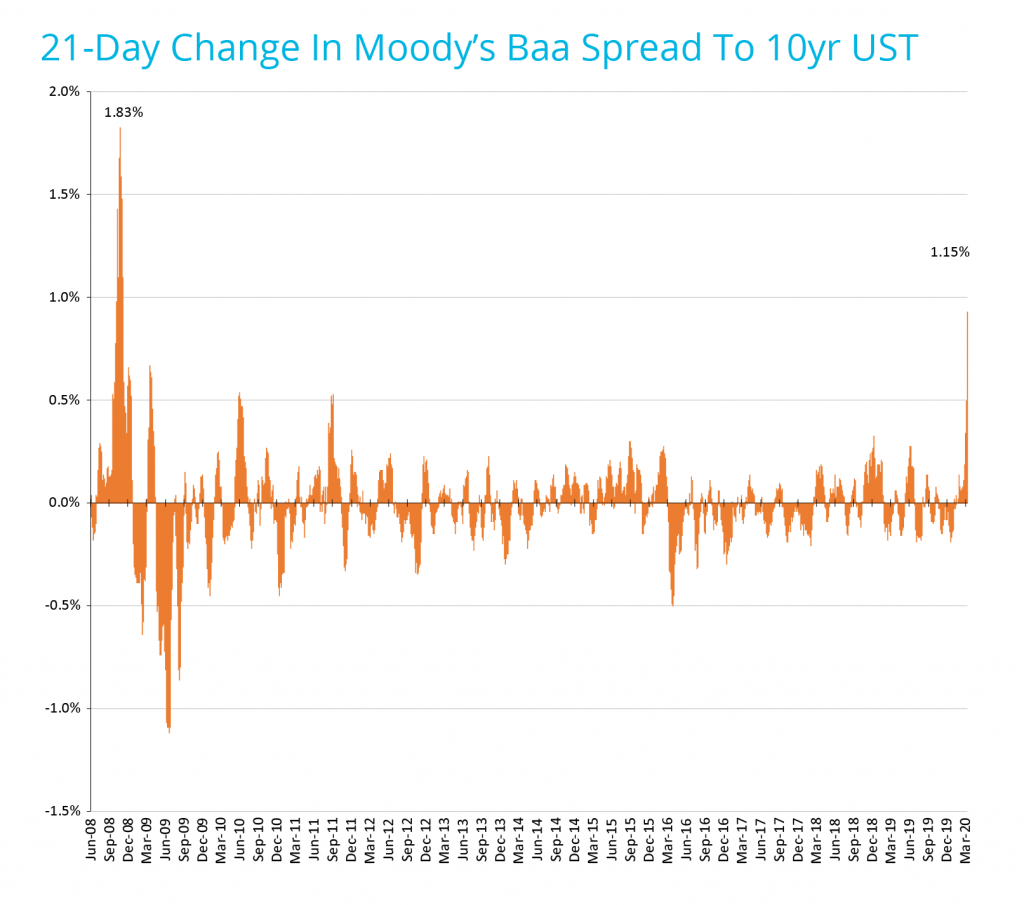

Non-investment grade corporate bond spreads – a measure of yield investors require for risky debt obligations relative to risk-free instruments – have widened even more dramatically. In fact, the 21-day change in corporate bond spreads is the highest since October 2008, at the height of the financial crisis. In other words, and as evidenced by the disparate performance of corporate and Treasury yields in Table 2, investors require increasing returns in exchange for increasing exposure to perceived risks.

Corporate Bond Market and Cost of Capital

Commercial real estate lenders very frequently benchmark commercial mortgage coupons with the corporate bond market. Therefore, borrowers’ benefit associated with the decline in benchmark interest rates will likely be overcome by an increase in lenders’ origination spreads. Moreover, buyer underwriting of income streams associated with a credit rating may also widen, hurting associated valuations.

Monitoring these changes will be paramount going forward. According to the Financial Times, approximately $1.5 trillion of the nation’s corporate debt is rated BBB, the lowest investment grade rating available to issuers. Also relevant, 40{ff66251fa959225ec0415bec498104472c710c05756e34120ff9c6ac4cef9161} of overall debt is rated non-investment grade. In the near future, it is likely some credit ratings will be downgraded due to impaired financial performance of underlying business models. The most probable sectors for such an outcome would be tourism and energy.

Commercial Mortgage Originations

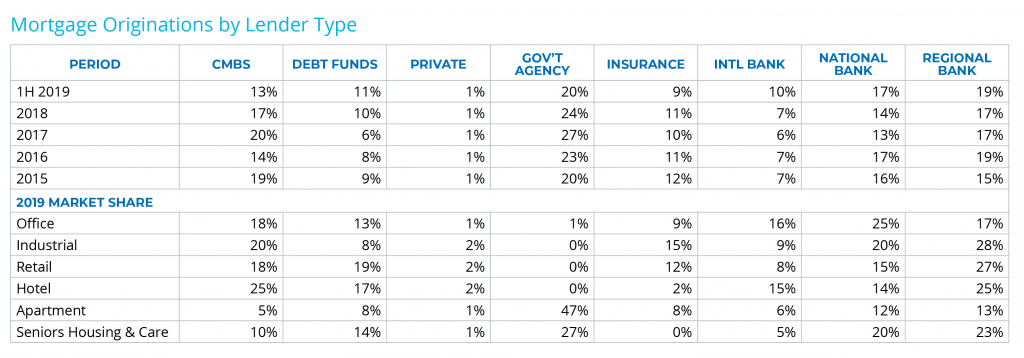

In addition to mortgage costs, market share among originators is an important consideration. In the runup to the 2007 financial crisis, CMBS lenders held approximately 54{ff66251fa959225ec0415bec498104472c710c05756e34120ff9c6ac4cef9161} market share of new mortgage originations. The resulting decline in liquidity available to borrowers precipitated a decline in underwritten values and, in the worst-case scenarios, foreclosures as highly leveraged real estate assets were unable to refinance existing indebtedness. While neither scenario exists today, a few observations are warranted.

Industrial and hotel assets have broadly benefitted from financing by two lending sources: CMBS and regional banks [see Table 3]. In periods of public market volatility, CMBS spreads can prove unpredictable until loan closing. Separately, regional banks may experience more unpredictable stances to mortgage origination, especially if their balance sheet is over-allocated to undermined segments of the economy. Note that retail and seniors housing also are dependent on regional bank originations.

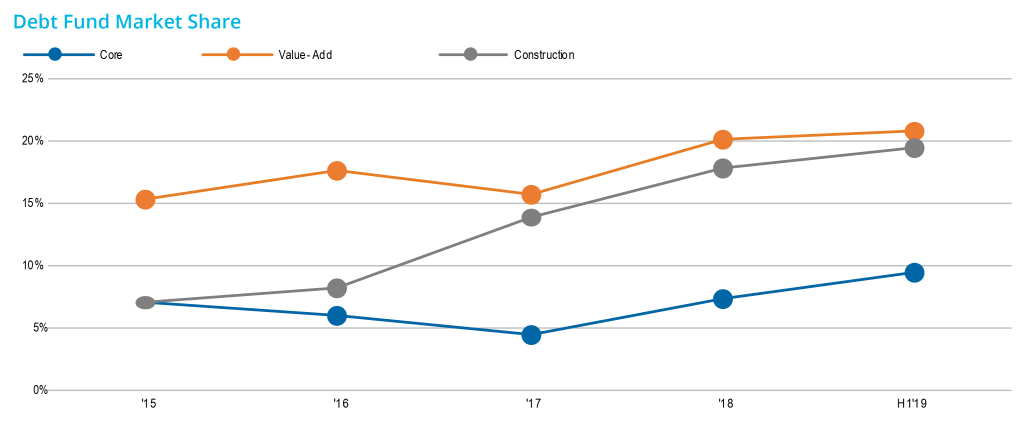

Though not responsible for more than 20{ff66251fa959225ec0415bec498104472c710c05756e34120ff9c6ac4cef9161} market share in any given property type, debt funds overall have experienced significant gains in market share in the past three years. Whereas CMBS and regional banks have exhibited preference for property types, debt funds have relied on investment strategy – notably value-add and construction opportunities. Approximately one of every five value-add and construction originations completed over the past 18 months has been capitalized using leverage from a debt fund lender. Given debt funds are backed with lines of credit from other lenders, and that value-add and construction investments are dependent on growth expectations, it is likely this segment of the market will experience disruption.

Geographic and Property-Specific Implications

In addition to debt markets, domestic equities have experienced contractions exceeding 20{ff66251fa959225ec0415bec498104472c710c05756e34120ff9c6ac4cef9161} as investors attempt to price-in lower valuations on lower earnings. The most deeply impacted sectors (as of this writing) include logistics, finance, tourism (lodging and commercial aviation) and energy. It is likely that property types directly associated, and employment bases with high concentrations in any of these industries, will underperform.

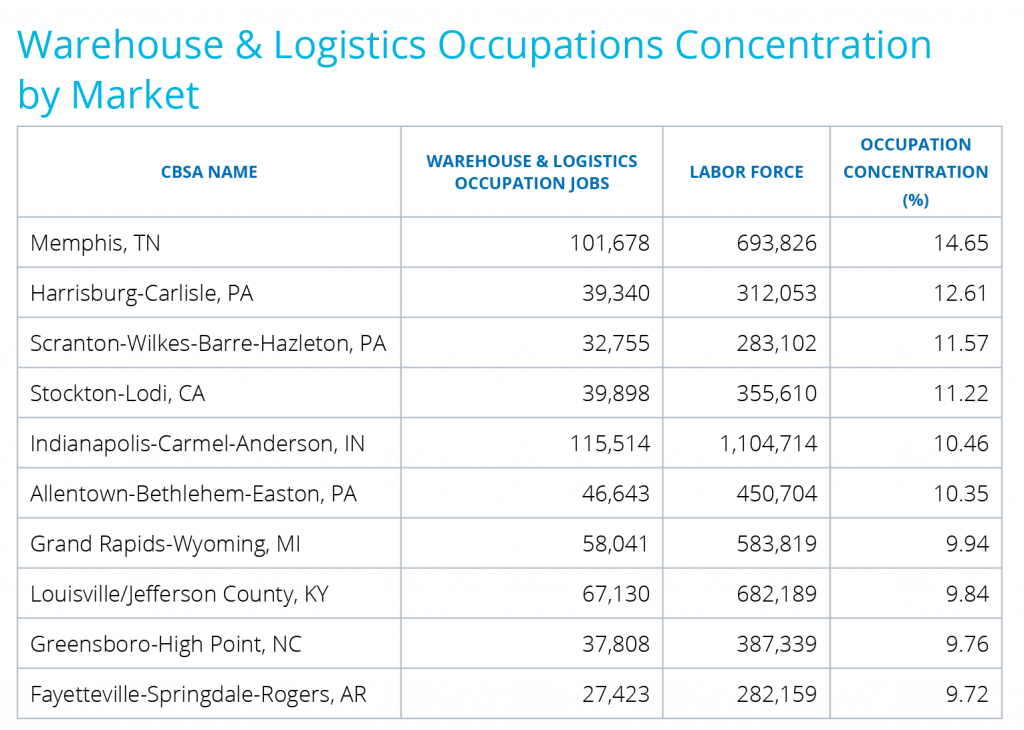

All major cities have logistics facilities, employing up to hundreds of thousands of citizens. However, certain locales have higher concentrations of this employment relative to the general population due to the presence of certain corporations or due to the or strategic nature of their geography. Markets with high concentrations of warehouse and logistics operations may experience disruptions in related tenant demand, especially for industrial properties. California’s Inland Empire, Chicago, Dallas-Fort Worth, North New Jersey and Atlanta are among the largest logistics hubs. However, it is smaller markets (Pennsylvania’s Lehigh Valley, Indianapolis, Memphis, Tennessee, Grand Rapids, Michigan, and Louisville, Kentucky) with higher concentrations of warehouse and logistics space that could more notably influence growth expectations.

Energy employment concentrations are another area to watch extremely closely, given the severe downward volatility in energy prices and implications for related employment. Markets including Houston, San Antonio and Oklahoma City each face recessionary pressure due to current contraction in the energy space. Energy downdrafts will likely play out most directly in the office sector, with other property types, including lodging, retail and multifamily, impacted due to weaker conditions for corporations and consumers. Other markets such as Denver and Dallas-Fort Worth are commonly mistaken as being largely energy dependent, but in fact are not.

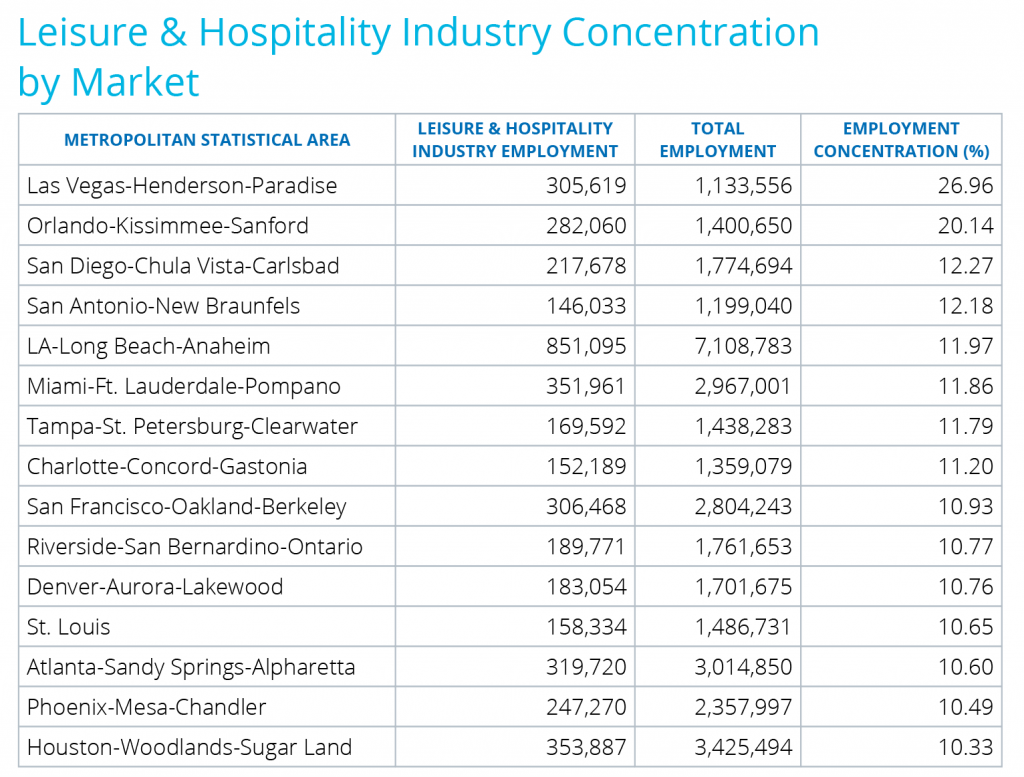

Due to immediate reductions in airline and lodging capacity, many MSAs dependent on Leisure & Hospitality will be negatively impacted. Markets including Las Vegas, Orlando, San Diego and San Antonio will certainly face diminution in tourism, which will immediately impact hotels, restaurants and entertainment venues and, over the long term, undermine the financial strength and confidence of the underlying consumer base.

The Centers for Disease Control’s guidance, and subsequent state- and city-level mandates to close certain businesses and limit gatherings in excess of 50 people will certainly impact retail, a sector that was already challenged by the increasing prevalence of consumers to fulfill demand online through e-commerce distribution channels. Moreover, investors’ preference for experiential retail assets that include a restaurant and/or bar component have forced closures. Not all retail assets will be impacted evenly, but recent momentum in fundraising and acquisitions, largely based on relative valuation to other property types, will surely decline.

As mentioned earlier in this analysis, lodging, healthcare and office assets have underperformed significantly, given they are directly impacted by the decline in demand and/or by their association with the spread of COVID-19. Year to date, substantially half of the property types represented by the REIT industry have now underperformed the S&P 500 [see Table 2]. For office assets, the move by many companies to work-from-home orientations inevitably will lead to further conjecture relating to the future of work. Already, the office sector has been undermined by the increasing adoption of coworking and an overwhelming flight to quality, with the majority of leasing velocity tilted to newer developments. Corporate America’s response to COVID-19 will not only lead to a slowdown in office leasing pace, it also will stimulate debate over secular shifts that may arise from a national workforce that could grow accustomed to a new workplace/home life balance.

Capital Markets Response

For years, market participants have been pricing in lower growth amid rising potential for a recession. As stated earlier, decreased growth expectations and end-of-cycle concerns undermined transaction volumes in 2016 and 2017, after setting an inter-cycle high in 2015. Similarly, a period of declining transaction volume, measured by velocity of sales and leasing, is probable for the foreseeable future as the market enters an extended period of price discovery.

Once 1Q 2020 earnings results are announced starting in early April, investors across multiple asset classes will benefit from required data necessary to evaluate impacts to demand, growth and corporate profitability. Asset returns will follow suit, but until then, private commercial real estate will be slow to respond. What we can expect is for debt underwriting to become more conservative, featuring more stringent treatment of future leasing, higher vacancy loss, lower growth rates, more conservative leverage on “business plan” assets and higher capitalization rates, especially in markets with exposure to concentrations of volatility relating to employment or credit risk.

RECOVERY WILL BEGIN WITH SOME POSITIVES

Dry powder remains near record highs and represents approximately 50{ff66251fa959225ec0415bec498104472c710c05756e34120ff9c6ac4cef9161} of annual transaction volumes. Leverage and debt-service-coverage ratios remain very conservative. In-place commercial leases are of a contractual nature and typically include rent escalations. Most developments have been well-capitalized with significant equity contributions, and funding commitments from lenders are only realized when the building is fully leased, thereby reducing “real” leverage behind funded equity. Moreover, many projects underway have benefitted from significant pre-leasing which moderates the risk associated both to the property owners and property fundamentals for surrounding assets. All of these factors, combined with ongoing, in-depth market intelligence, will allow commercial real estate constituents to face the inevitable future challenges with poise, optimism and a strong framework for decision making.

Sources: Transwestern, Real Capital Analytics, Real Capital Analytics/Moody’s, Cornell University, Hodes Weill, Morgan Stanley Research, The Financial Times, S&P Global Ratings, Bloomberg, MSCI, National Association of Real Estate Investment Trusts, JPMorgan, Thomson Reuters, SNL Financial, Bureau of Labor Statistics, EMSI, Barclays, related company filings

About Us

Transwestern advises clients on real estate strategy, site selection, lease-up and disposition of commercial assets, property and project management, portfolio strategy, debt and equity financing, and development.

Transwestern Research & Data Analytics

In markets across the country, Transwestern research and data analytics professionals produce sophisticated data intelligence, local market analyses and insight on national trends that help clients make informed real estate decisions.