By Leah Gallagher

The threat of shorter office lease terms has been looming over the commercial real estate industry for several years. Companies first braced for the potential impact of new standards from the International Accounting Standards Board (IASB) recognizing all leases on the balance sheet, which took effect in January 2019. Then, the office leasing world was hit with additional challenges from COVID-19 as many companies opted to work from home and re-evaluated the role of their physical office space.

Many major corporations and large firms have chosen to postpone decisions to sign new office leases or commit to long-term renewals. This has seemingly led to a flood of short-term renewals of 12 to 18 months while organizations try to achieve better clarity on their ability to safely bring employees back to the workplace.

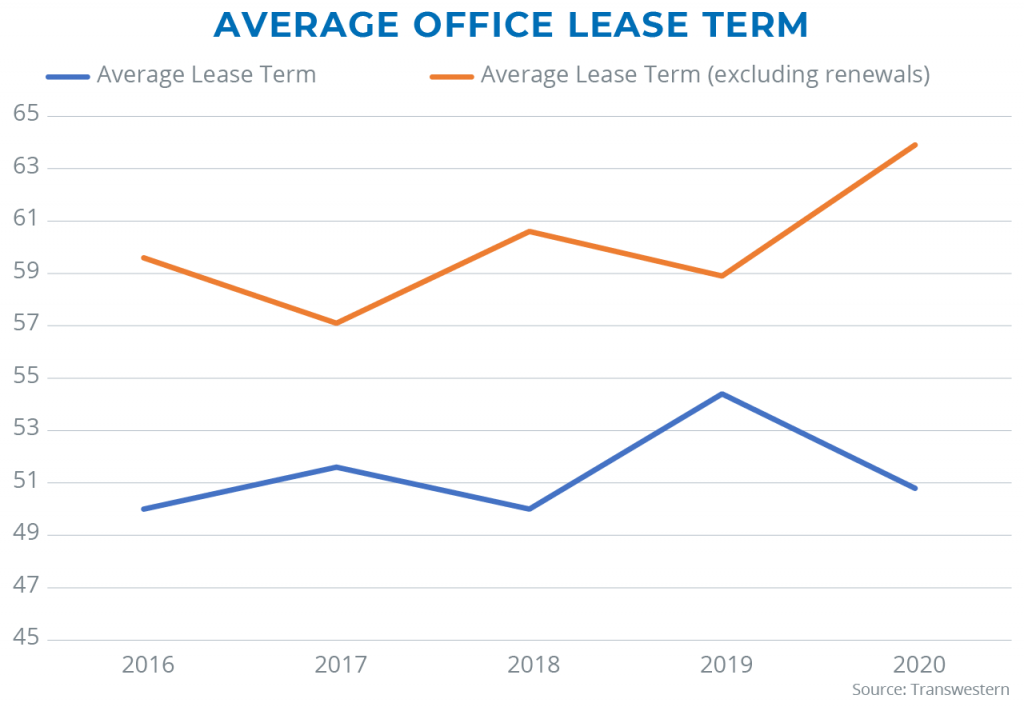

However, data from Transwestern’s San Antonio leasing teams reveals there has been little to no impact on office lease term length from either new accounting standards or COVID-19. Analyzing internal transaction data of 835 office leasing transactions since 2016 determined that the average office lease term in the San Antonio market is 51.8 months. This average includes new leases, expansions, relocations, renewals and reductions. In 2020, the average lease term was 50.8 months – only a 2% decline from the five-year average. If focusing only on new leases, relocations and expansions, the 2020 average office lease term is 63.9 months compared to 58.6 months in 2019, a 9% increase. By removing renewals and reductions, it’s clear how companies that executed short-term renewals due to uncertainty surrounding their return to the office impacted the overall average in 2020.

While investors tend to view short-term leases as a potential to cause instability in their cash flow, they are not an insurmountable obstacle when it comes to marketing an office property or underwriting one for acquisition. When underwriting any office acquisition, it is critical that the investor have a clear understanding of how the building tenants use the office space, their recruiting objectives, and their reason for selecting the office asset in the first place.

Some office tenants, such as sales companies, find that productivity and internal competition suffers in a remote work environment and are anxious to return to the workplace. Other tenants that must navigate secure systems or remain in compliance with specific federal guidelines find that it is imperative to maintain an office presence. And yet others like those in creative industries may rely on highly collaborative office spaces to execute projects.

In addition to a deep understanding of the tenant company’s business, investor underwriting in 2020 included additional tenant scrutiny such as rent relief considerations, lease restructuring due to cash flow constraints, and plans for returning to the workplace. Once an investor and lender are comfortable with the tenant’s commitment to the office location and financial reputation, the timing of the lease expiration and forecasted market rates are analyzed to measure how impactful this renewal or vacancy may be to the cash flow.

In situations where there is limited supply, the near-term expiration of a tenant paying below-market rates will be viewed favorably by investors as a mark-to-market opportunity. On the other hand, if there is an abundance of available options or the tenant is paying an above-market rental rate, the investor will likely reduce the retention ratio of the tenant and base their offer on market rents rather than in-place rents.

It’s understandable why investors of income-producing office properties will continue to view short-term leases and near-term expirations as a threat to the stability of the asset’s net operating income. However, thorough due diligence may reveal that the exposure is less concerning than it appears on paper. Given the variety of risk tolerance in commercial real estate investment, there will continue to be an appetite for office assets with both short- and long-term lease exposure.

Leah Gallagher serves as the city leader for Transwestern’s San Antonio office. Before assuming the leadership role, she was Managing Director in the Capital Markets group based in Austin.