By Rob Murphy

Congress recently passed its third piece of legislation aimed at combating the novel coronavirus. Phase 3, as it has been referenced, will be the most expensive stimulus package in U.S. history. While the first two pieces of legislation increased funding for existing government programs, Phase 3 opens the Treasury’s coffers to a diverse group of constituents not normally dependent on government financing. The White House and Congress have identified a wide variety of affected parties eligible for the Phase 3 relief.

Phases 1 and 2 mainly focused on providing emergency funding for federal programs, as well as strengthening individual job-loss related programs. Provisions included free individual coronavirus testing, two weeks of paid sick and family leave for coronavirus patients, expanded unemployment insurance, and increased funding for Medicaid and the Supplemental Nutrition Assistance Program. The measures included in Phases 1 and 2 are estimated to cost more than $100 billion.

Phase 3, or the Coronavirus Aid, Relief and Economic Security (CARES) Act, was signed into law by President Trump on March 27, 2020. The CARES Act provides immediate relief for individual taxpayers, small business owners, large corporations, hospitals, and state payments for their unemployment programs and reimbursement of coronavirus-related expenses. The price tag for the CARES Act alone exceeds $2 trillion.

Below is a summary of key CARES Act provisions receiving the bulk of the funding:

Paycheck Protection Program

$350 billion aimed at providing eight weeks of cash flow assistance for small businesses.

- To qualify, a business must employ no more than 500 employees or meet industry size standards defined by the Small Business Administration (SBA), have been operational on Feb. 15, 2020, and have been paying employees at the time.

- Loans will be immediately disbursed through SBA-certified and newly certified lenders.

- Loan amount shall be equal to 250{ff66251fa959225ec0415bec498104472c710c05756e34120ff9c6ac4cef9161} of average monthly payroll, plus the outstanding loan amount from a SBA Disaster Loan originated after Jan. 30, 2020, if applicable. In any event, a Paycheck Protection Program loan is not to exceed $10 million.

- Business is eligible for loan forgiveness if it maintains the same number of employees as was reported in last year’s payroll for a minimum of eight weeks after the loan is disbursed.

- Expenses eligible for loan forgiveness include payroll, rent, mortgage, insurance and utility payments made during the eight weeks after loan disbursement.

- Business can re-hire previously laid-off employees up to June 30 to maximize loan forgiveness.

As it stands, the Paycheck Protection Program empowers the Small Business Administration to coordinate rescue packages for small business owners. The CARES Act also streamlines the SBA’s Economic Injury Disaster Loan and Express Loan programs to better handle this crisis. In addition to the Paycheck Protection Program loans, the program provides small business owners with financing for working capital and operating expenses while simultaneously cutting documentation requirements with the goal of delivering proceeds in the hands of borrowers faster. Additionally, sole proprietors and independent contractors can participate in the Disaster Loan program. Small business owners are strongly encouraged to contact their SBA 7(a) lender immediately to discuss potential recovery loans.

Entrepreneurial Assistance

- $265 million for grants to SBA partners, including Small Business Development Centers and Women’s Business centers, for counseling and assistance to businesses affected by the virus.

- $10 million for the Minority Business Development Agency.

Recovery Rebates for Individual Taxpayers

- $1,200 refundable tax credit (cash payments) for individuals and $2,400 for joint filers.

- Taxpayers with children will receive a $500 rebate per child.

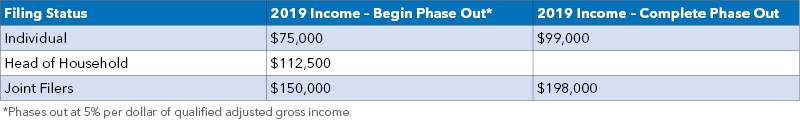

- Rebates will phase out for higher income earners, with the highest taxpayers not eligible:

Rescue Packages

- $25 billion in loans and guarantees for passenger air carriers.

- $4 billion in loans and guarantees for cargo air carriers.

- $17 billion in loans and guarantees for businesses critical to maintaining national security.

- $454 billion and any amounts not used for the industries listed above shall be available for programs established by the Federal Reserve to maintain liquidity in the financial system including the ability to purchase assets issued by municipalities, states, or eligible businesses.

Additional Funding

- $150 billion for the healthcare system, including funding for hospitals, research, treatment, and purchase of equipment such as ventilators and masks for the Strategic National Stockpile.

- $150 billion for state and local governments to address budget shortages caused by the virus.

- $170 billion in emergency appropriations for executive departments, such as the Department of Housing and Urban Development and the Department of Education.

- Funding for extended unemployment benefits including an increase of $600 per week for up to four months. Self-employed and gig economy workers are eligible.

Real Estate Provisions

The CARES Act provides a 60-day foreclosure moratorium and loan forbearance eligibility for all federally backed residential loans. A homeowner with such a loan has the option of exercising a 180-day forbearance by submitting a request to the loan servicer and affirming a coronavirus-related hardship. Servicers must notify a borrower of their right to request a forbearance during this period of national emergency. Additionally, a multifamily borrower with a federally backed loan that was current as of Feb. 1, 2020, may request a 30-day forbearance.

The CARES Act also retroactively amends a portion of the 2017 Tax Cut and Jobs Act (TCJA) addressing bonus deprecation rules in the tax code. The TCJA inadvertently penalized taxpayers of qualified improvement property, notably commercial real estate owners, restaurants, and retailers, with a much longer depreciation schedule. Starting Jan. 1, 2018, it subjected them to a 39-year depreciation schedule rather than the intended 100{ff66251fa959225ec0415bec498104472c710c05756e34120ff9c6ac4cef9161} bonus depreciation. The CARES Act amends the error and provides 100{ff66251fa959225ec0415bec498104472c710c05756e34120ff9c6ac4cef9161} bonus depreciation eligibility for qualified improvement property.

While the CARES Act is a robust package intended to provide immediate coronavirus relief to national stakeholders, there are preliminary discussions for additional measures.

In providing this insight, Transwestern is not providing legal, tax or accounting advice. You are strongly encouraged to contact your CPA and to seek legal counsel to review your eligibility to participate in any of the programs covered in Three Coronavirus Stimulus Packages.

Get more insight from these trusted sources:

Baker Botts | KPMG | Foley & Lardner LLP | Ernst & Young | Thompson Knight | RSM

Rob Murphy provides debt and equity placement services for Transwestern’s institutional and corporate clients nationwide.