Broadening real estate decision factors leads to better outcomes

by Andrew Matheny

In the current business climate, economic incentives carry greater significance in real estate location strategy and are a means by which state and local governments catalyze growth. Incentives create win-win solutions, helping companies offset capital and operating expenditures while stimulating regional and local economic progress by attracting jobs and business investment. When negotiated and executed properly, economic incentives create more opportunity, infuse more resources into communities, and lower the public’s tax burden by making local and regional economies more sustainable and resilient.

A tight labor market and inflationary environment have driven a steep rise in operating and investing costs, leading companies of all sizes and industries to look for opportunities to improve their business and financial performance. The expansive array of tax structures and incentive programs across the nation creates both possibilities and challenges for companies looking to identify, analyze and compare what’s available within and outside their city and state – and to incorporate this data into overall real estate decision making.

Qualifying for Economic Incentives

Although incentive deals for large companies and mega-projects dominate press coverage, the reality is many states and localities have created robust programs for companies of all sizes, even early-stage startups. Tax credits, rebates and abatements are the most common types of incentives for companies opening, relocating or expanding operations. But the opportunities don’t end there: many states offer workforce training grants to assist with upskilling employees for positions that are difficult to fill in today’s tight labor market.

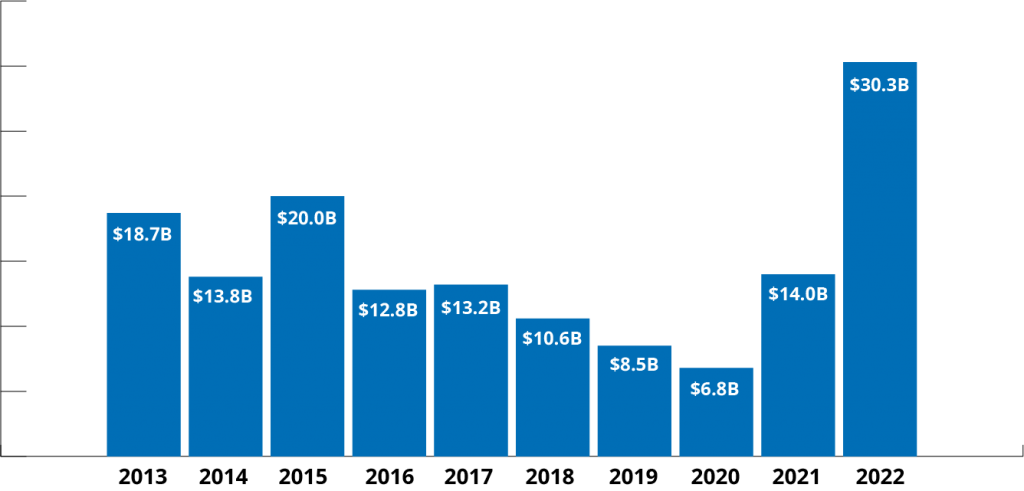

Total Incentives Awarded

Incentives can also support creative real estate initiatives with meaningful impacts, such as adaptive reuse projects or community revitalization. When financial incentives aren’t available, non-financial assistance such as expedited permitting may be offered to accelerate project completion.

Many communities are eager to provide incentives to retain companies with a proven track record as strong community partners.

Incentives for business retention are often the most overlooked. Financial considerations often lead companies to consider relocating even when existing real estate is well-located to attract talent and well-suited for current operations. Many communities are eager to provide incentives to retain companies with a proven track record as strong community partners. In these cases, economic incentives may create a compelling solution for companies to remain in-place and reduce real estate costs by renovating existing space, consolidating multiple locations, or performing small incremental expansions.

Strategizing the Opportunities

What are the pros and cons of one location over another? Which incentives are suitable for my business? What is the short- and long-term value? Which programs carry the most administrative burdens? These are but a few considerations that go into qualifying, analyzing and negotiating economic incentives.

Just because a program is available doesn’t mean it’s the right fit for a company. For instance, some programs require commitments to create a certain number of jobs every year; therefore, they may not be the best option for companies and industries where growth isn’t steady. Considering incentive options early in the decision-making process ensures a company isn’t leaving opportunities on the table. Specialized expertise and data assist brokerage teams and corporate real estate managers in making sound recommendations that support the business strategy.

Considering incentive options early in the decision-making process ensures a company isn’t leaving opportunities on the table.

By understanding how incentives impact a company’s operations, workforce, structural costs, tax liability and financial statements – and leveraging robust technology and data analytics to uncover the best opportunities – an organization can reduce operating costs and increase net income.

Incentives experts enhance success for clients by understanding the local business climate, tax environment and priorities of various economic development agencies. They know which programs can achieve a desired outcome and how to develop a compelling story that align an organization’s goals with the goals of their communities.

Negotiating and Understanding the Compliance Challenge

Nearly all economic incentive programs are performance-based, meaning companies must achieve specified objectives and fulfill certain reporting obligations to maintain qualification. Reporting periods and procedures vary, and virtually all agreements include “claw back” provisions.

Negotiation is critical: terms and conditions are always as important as the amount of an economic incentive.

Governments use claw back provisions as a safeguard to ensure incentive agreements achieve the intended goals. For example, a government that gives a company a tax credit to relocate 50 jobs will typically require the recipient to maintain a certain number of employees over five years to continue receiving the credit. If the company’s employment falls below this level at any time, the government may terminate the agreement and demand repayment.

Terms and conditions are always as important as the amount of an economic incentive. Before an incentive is consummated, companies must understand the conditions and requirements presented in the term sheet and final agreement. Renegotiation may be possible if circumstances change but may come at a financial and reputational cost.

Though not the sole factor in real estate decisions, incentives can net big rewards, which is why experts skilled in the complexities of evaluating, negotiating and executing these agreements are often tapped to support a real estate assignment. Furthermore, incentives are constantly evolving, so gaining access to real-time and historical deals to compare opportunities across geographies and industries – as well as against quantitative and qualitative benchmarks – is the surest way to optimize results.

Andrew Matheny

Research Manager & Economic Incentives Leader

With extensive experience at local, regional and state economic development organizations, Transwestern’s Economic Incentives Advisory Group keeps a pulse on current programming across the country and collaborates with advisors nationwide to perform robust analysis that helps clients create an optimized site selection strategy that maximizes success.